Page 15 - BOSS Today Issue 57

P. 15

BOSS Today #57

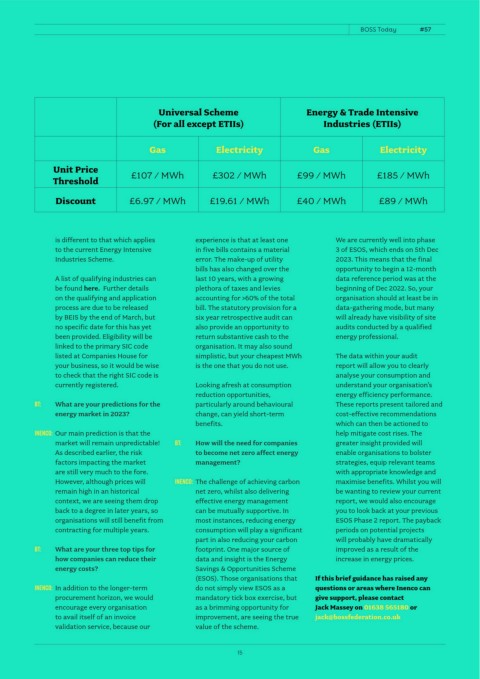

Universal Scheme Energy & Trade Intensive

(For all except ETIIs) Industries (ETIIs)

Gas Electricity Gas Electricity

Unit Price

Threshold £107 / MWh £302 / MWh £99 / MWh £185 / MWh

Discount £6.97 / MWh £19.61 / MWh £40 / MWh £89 / MWh

is different to that which applies experience is that at least one We are currently well into phase

to the current Energy Intensive in five bills contains a material 3 of ESOS, which ends on 5th Dec

Industries Scheme. error. The make-up of utility 2023. This means that the final

bills has also changed over the opportunity to begin a 12-month

A list of qualifying industries can last 10 years, with a growing data reference period was at the

be found here. Further details plethora of taxes and levies beginning of Dec 2022. So, your

on the qualifying and application accounting for >60% of the total organisation should at least be in

process are due to be released bill. The statutory provision for a data-gathering mode, but many

by BEIS by the end of March, but six year retrospective audit can will already have visibility of site

no specific date for this has yet also provide an opportunity to audits conducted by a qualified

been provided. Eligibility will be return substantive cash to the energy professional.

linked to the primary SIC code organisation. It may also sound

listed at Companies House for simplistic, but your cheapest MWh The data within your audit

your business, so it would be wise is the one that you do not use. report will allow you to clearly

to check that the right SIC code is analyse your consumption and

currently registered. Looking afresh at consumption understand your organisation’s

reduction opportunities, energy efficiency performance.

BT: What are your predictions for the particularly around behavioural These reports present tailored and

energy market in 2023? change, can yield short-term cost-effective recommendations

benefits. which can then be actioned to

INENCO: Our main prediction is that the help mitigate cost rises. The

market will remain unpredictable! BT: How will the need for companies greater insight provided will

As described earlier, the risk to become net zero affect energy enable organisations to bolster

factors impacting the market management? strategies, equip relevant teams

are still very much to the fore. with appropriate knowledge and

However, although prices will INENCO: The challenge of achieving carbon maximise benefits. Whilst you will

remain high in an historical net zero, whilst also delivering be wanting to review your current

context, we are seeing them drop effective energy management report, we would also encourage

back to a degree in later years, so can be mutually supportive. In you to look back at your previous

organisations will still benefit from most instances, reducing energy ESOS Phase 2 report. The payback

contracting for multiple years. consumption will play a significant periods on potential projects

part in also reducing your carbon will probably have dramatically

BT: What are your three top tips for footprint. One major source of improved as a result of the

how companies can reduce their data and insight is the Energy increase in energy prices.

energy costs? Savings & Opportunities Scheme

(ESOS). Those organisations that If this brief guidance has raised any

INENCO: In addition to the longer-term do not simply view ESOS as a questions or areas where Inenco can

procurement horizon, we would mandatory tick box exercise, but give support, please contact

encourage every organisation as a brimming opportunity for Jack Massey on 01638 565180 or

to avail itself of an invoice improvement, are seeing the true jack@bossfederation.co.uk

validation service, because our value of the scheme.

15